How Real Estate Reno Nv can Save You Time, Stress, and Money.

Table of ContentsSome Known Factual Statements About Real Estate Reno Nv About Real Estate Reno NvGetting My Real Estate Reno Nv To WorkEverything about Real Estate Reno NvThe 6-Minute Rule for Real Estate Reno NvNot known Facts About Real Estate Reno Nv

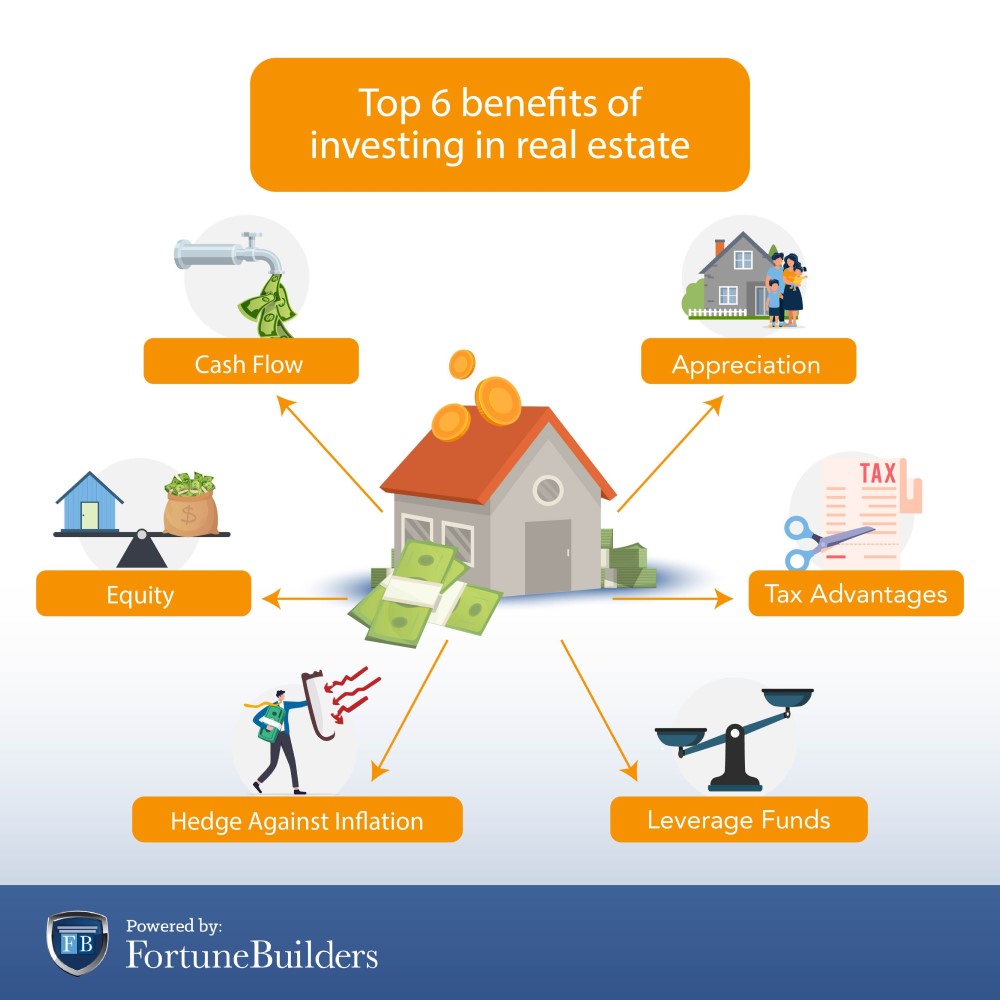

With the ideal upkeep and management, you might produce a constant rental revenue even if a residential or commercial property's worth stays level for some time. All investors should hence do their research prior to devoting to a purchase in a particular area. A REIT can be successful in 2 various methods: First, REITs routinely pay rewards to capitalists.Take advantage of, or the capacity to take down a little quantity of one's own money and obtain the remainder to acquire a residential or commercial property, is a vital benefit of property investing. Spending in top notch realty for as little as 15% of the whole cost, taking down a down settlement from financial savings, and obtaining a home loan to pay the remaining quantity.

It also makes sure that an individual will only invest a part of their incomes in property. Real Estate Reno NV. As a result of the increased use of innovation and the demand for more comfort and comfort in every day life, there has been a stable surge in the demand for wise homes in India over the previous couple of years

The Main Principles Of Real Estate Reno Nv

To lessen the unfavorable effects of housing advancements on the environment, designers are also prompted to focus on utilizing environment-friendly materials in construction. It's essential to keep in mind that India is only just beginning to embrace clever homes, and the industry is still establishing. Therefore, clever residences might just be used in a couple of places or projects, and their installation and maintenance expenses may be above those of conventional homes.

In India, purchasing realty is a protected type of financial investment. Compared to other properties like the securities market, gold, cryptocurrencies, and even banks, spending in property can be far safer. The stock exchange is always changing, therefore making it rather risky. Compared to various other service financial investment options like shares and mutual funds, realty investing in India has a reduced volatility ratio.

Commercial actual estate is commonly recognised as a better financial investment alternative. Domestic real estate comes close to commercial real estate.

Rumored Buzz on Real Estate Reno Nv

The practice of buying realty as a financial investment instead of an irreversible house to earn money is referred to as property investing. It may be simply called any type of piece of land, structure, facilities, or other substantial assets that can be transferred for a profit even if it is frequently unmovable.

For some, buying realty can equate to hundreds of dollars in added revenue each year. And specialists state that in today's inflationary atmosphere, doing so could prove to be a tactical move. "A property financial investment supplies a hedge versus rising cost of living if leas maintain rate with, or outpace, the rate of rising cost of living," states Derek Graham, principal and owner of Odyssey Characteristic Team.

The 9-Second Trick For Real Estate Reno Nv

"The degree of earnings generated hinges on both the location and kind of property property." Graham notes that property investments usually have a reduced correlation to the stock market, so you can use them to hedge versus losses during market slumps. Having a diverse mix of properties in your profile also spreads your risk out across asset types, implying you'll have a greater opportunity of triumphing when several of your other properties aren't doing as well.

Extra income source, Portfolio diversification, Tax breaks Possibly a lot more hands-on, Direct home investments are illiquid There are a number of ways to purchase property, either straight or indirectly. Depending upon the course you take, not all sorts of real estate investments will certainly need a heap of time or funding.

"Sometimes, investors could require just a few thousand bucks to begin." A few common methods to participate the realty game, include: This is when you acquire all or a stake in a specific property such as an apartment or condo, home, real estate complicated, buying center, or business office complex.

Rumored Buzz on Real Estate Reno Nv

Investing in real estate continues to be one of the finest ways to accumulate wide range, both in terms of recognition in market value as well as generating a reputable month-to-month cash money circulation. Historically, real estate has actually been less volatile than the supply market, particularly through harder economic times.

Maritz shares the major benefits of realty investment:: Unlike many various other financial investments, realty has the capability to produce cash circulation, either in the helpful hints kind of profit once you have actually settled your home loan or as rental income, whether from an income-producing useful content flatlet on your primary house or from different residential properties.

The 5-Minute Rule for Real Estate Reno Nv

: Normally, the worth of properties appreciates with time which means that the longer you've had a home, the much more it will deserve, making it the optimal nest egg.: As an actual estate driver, you have the ability to deduct items such as interest and maintenance in time as company write-offs.